Top OEM Manufacturers of Industrial Rubber Products for Best Quality

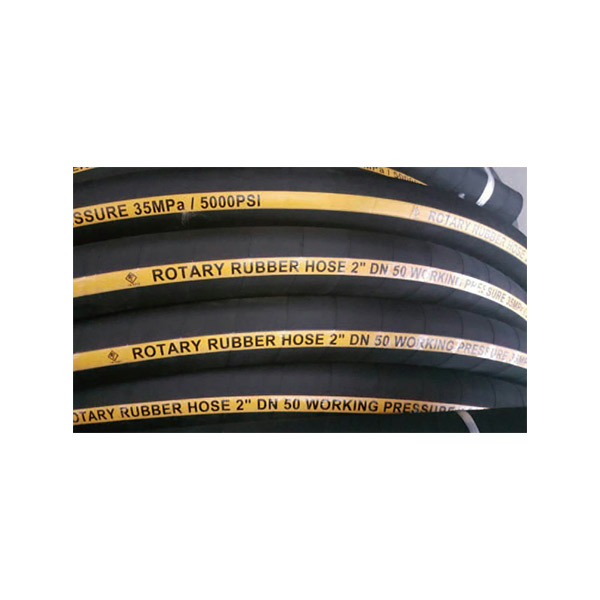

As a purchaser in the industrial sector, I understand the importance of reliable suppliers. That's why I focus on sourcing high-quality industrial rubber products tailored for OEM needs. Our extensive range of rubber components is engineered to meet the stringent demands of various manufacturing processes. Whether it's seals, gaskets, or custom rubber fabrications, our offerings are designed for durability and performance. Partnering with reputable manufacturers ensures that I get products that not only meet specifications but also provide value for money. I prioritize suppliers who use premium materials and advanced manufacturing techniques, guaranteeing longevity and resistance to wear. It's vital for me to work with companies that stand behind their products and offer excellent support. If you’re seeking dependable industrial rubber solutions that can enhance your production efficiency, I’m here to help you connect with the right manufacturers who understand our industry's unique requirements. Together, we can drive innovation and productivity in our operations.

Industrial Rubber Products Application Leads the Global Market

In the dynamic landscape of industrial manufacturing, the application of rubber products has emerged as a cornerstone for various industries worldwide. With advancements in technology and increasing demand for durable, efficient materials, industrial rubber products are seeing unprecedented growth in their application across sectors such as automotive, aerospace, construction, and electronics. These products not only provide vital support in terms of performance and safety but also enhance the overall efficiency of machinery and equipment. Global procurement professionals are keenly aware of the balance between quality and cost-effectiveness. As economies evolve and markets become more competitive, sourcing high-quality rubber components is essential. Innovations in rubber formulations, including those that improve resilience, heat resistance, and longevity, are leading the way for manufacturers to offer products that meet diverse operational needs. By integrating advanced manufacturing techniques, suppliers can ensure that their products comply with international standards, thereby gaining the trust of buyers across the globe. As sustainability remains a key concern, the industry is also witnessing a rise in the production of eco-friendly rubber products, which appeal to environmentally conscious enterprises. The shift towards sustainable practices not only addresses environmental concerns but also opens new avenues for growth in emerging markets. By leveraging the benefits of industrial rubber products, businesses can enhance their operational efficiency while contributing to a greener future, making it an attractive proposition for global buyers looking to stay ahead in an ever-evolving marketplace.

Industrial Rubber Products Application Leads the Global Market

| Application Area | Market Share (%) | Growth Rate (%) | Region | Key Trends |

|---|---|---|---|---|

| Automotive | 35 | 5.2 | North America | Increased demand for electric vehicles |

| Construction | 30 | 4.8 | Asia-Pacific | Urbanization and infrastructure projects |

| Medical Devices | 15 | 6.1 | Europe | Innovations in healthcare |

| Consumer Goods | 10 | 3.5 | Latin America | Growing disposable income |

| Industrial Machinery | 10 | 4.0 | Middle East & Africa | Investment in manufacturing technologies |

Related Products